This is completely a scam!

We spent one months following up on the progress of the service, and another month appealing to the customer and third-party platform, but ultimately lost everything.

We paid all the payments for the products, did not receive any service fees, and were penalized by third-party platforms, wasting a significant amount of time, even though it was not our fault.

Although we are very angry, at here, we still choose to protect this customers’ information here and will not display their names, nationalities, company names, phone numbers, email addresses, and other information.

We name this customer as RB in this article.

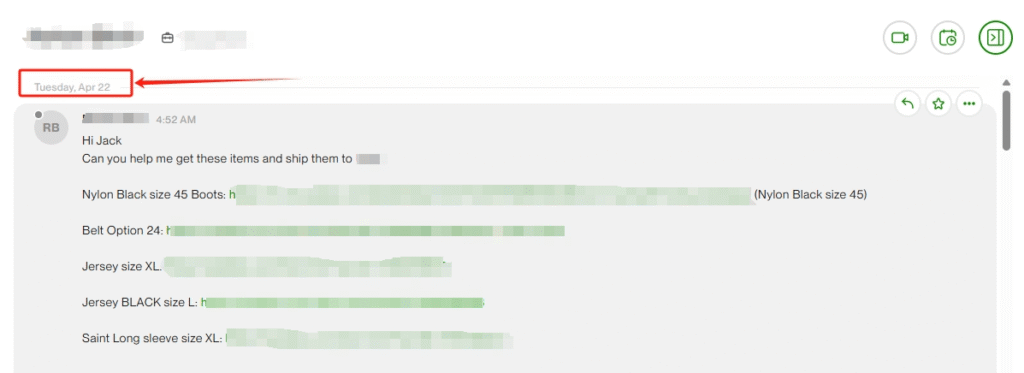

On April 22nd

RB contacted us on Upwork.com, and asked us to help him buy some clothes and ship to him.

We quickly replied to the customer RB and communicated the service plan with him.

Then, the customer RB disappeared for a week.

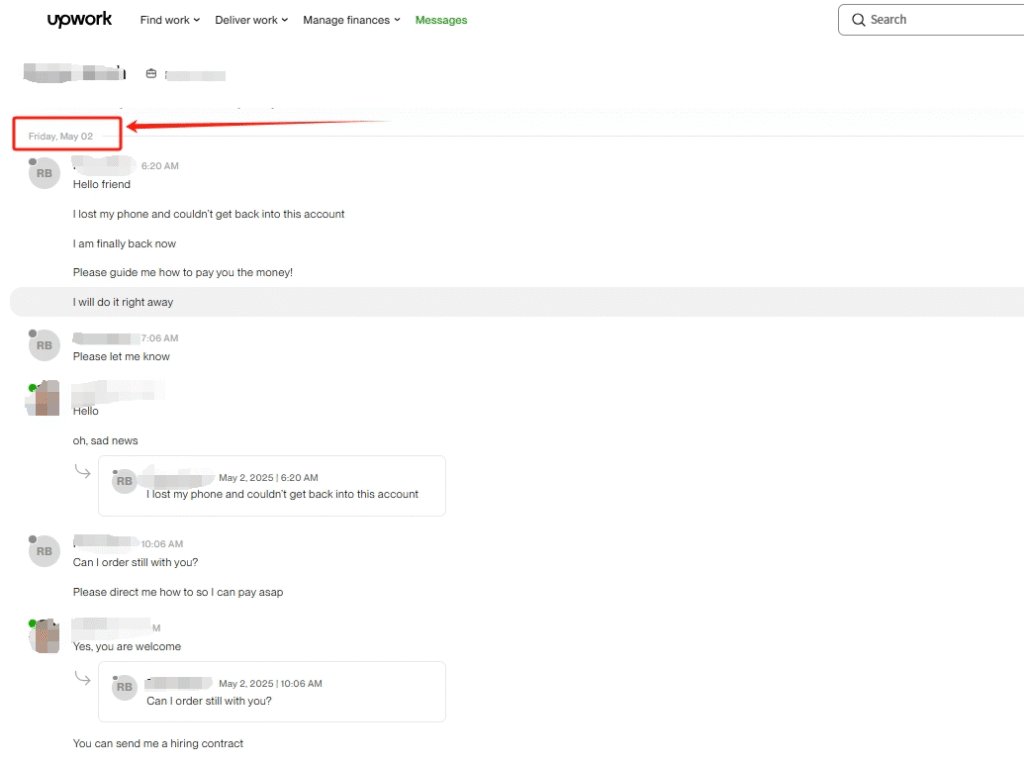

On May 2nd

Customer RB appeared on Upwork again and stated that he had lost his phone, so he could not be reached. And he expressed his intention to start working together.

So, the customer RB gave us an service offer. We accepted it.

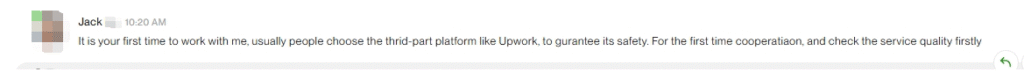

But after that, the customer RB stated that he did not want to complete this job on the Upwork platform as he needs to pay a handling fee to Upwork.

Although we complied with Upwork’s terms and policies, and advised the customer RB to complete this order on Upwork. However, he insisted on using Payoneer.com for payment.

In the end, client RB cancelled Upwork’s contract, requested us to provide Payoneer.com account for payment.

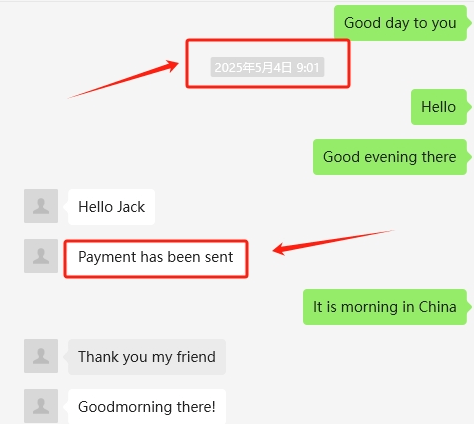

On May 4th

The customer RB completed the payment on Payoneer.com.

Then we started purchasing clothing.

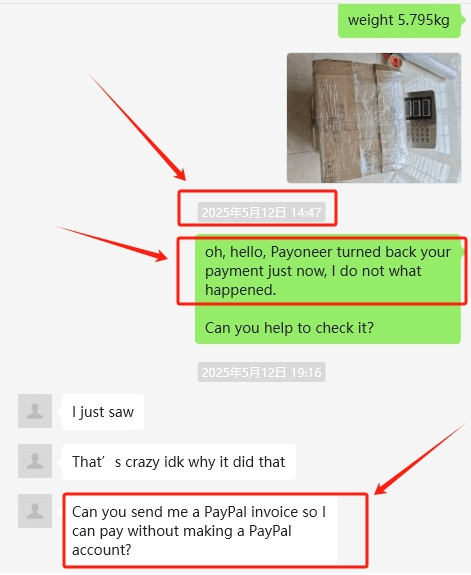

On May 12th

We completed all the clothing purchases and got all the products from the suppliers.

We made pictures and videos, sent to the customer RB, let him check the quality and details whether these products met his requirements.

After everything was confirmed, we packed all the products and called FedEx to pick them up.

When the FedEx receiver was on the way, we suddenly received an E-mail from Payoneer.com stating that customer RB had applied for a refund and had successfully completed the refund.

This means that we would pay for all goods and shipping costs, and provide purchasing services free of charge. We had a bad premonition, we are also curious why Payoneer.com can process refunds directly without the recipient’s consent.

Fortunately, the goods had not been taken away yet.

So we urgently called FedEx, announcing the temporary cancellation of shipping and contacting customer RB.

The customer RB requested payment through PayPal Invoice and requested us to ship the product as soon as possible.

At that time, we didn’t think too much about it, after all, the customer was willing to make another payment.

So, we created a PayPal invoice and sent the link to the customer RB.

However, in the following days, the customer lost contact again.

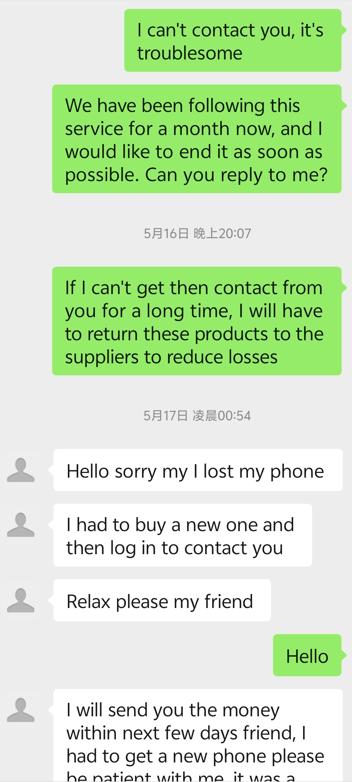

On May 16th

Due to the prolonged inability to contact customer RB, we decided to return the products to the suppliers for a refund to minimize losses. So we told this to customer RB.

Then we received a response from the customer RB finally, who claimed that he lost his phone once again.

There is a key point. This chatting app is WeChat, similar to WhatsApp, and can usually only be used on mobile phones. Before logging in to the computer version, mobile phone verification is also required. So he didn’t lose his phone, otherwise he wouldn’t be able to reply to messages on WeChat.

We felt like we had fallen into a scam.

Sure enough, although the customer RB has been claiming to make the payment, we had never received it.

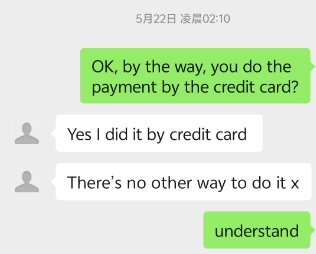

On May 22nd

The allowed return deadline for the products was about to expire, and we couldn’t wait any longer.

So we told the customer RB that we would return the products.

As a result, customer RB completed the PayPal Invoice payment after learning about our action plan. Why didn’t he complete the payment earlier?

However, we also feel that something is not right because the customer RB had already received a refund on Payoneer.com, and we were concerned that the payment on PayPal may also be refunded too.

So, we consulted the information on Payoneer.com to understand why customer RB was able to successfully complete the refund without our knowledge. The results show that the refund is initiated by the credit card institution of customer RB, and Payoneer.com must issue an unconditional refund.

This also means that this refund was intentionally requested by customer RB.

And, we read PayPal’s seller protection policy too, url: https://www.paypal.com/c2/legalhub/paypal/seller-protection

As clearly stated in PayPal’s policy, as long as the customer’s payment method is using a credit card or a non-PayPal account(PayPal Invoice is one way of non-PayPal account payment), the payer can receive a refund unconditionally.

So even if customer RB makes another payment, he can still successfully complete the refund application again.

We realized that this was simply a scam! However, the return time for the products has exceeded the deadline, because May 23rd has already arrived.

We are destined to face losses.

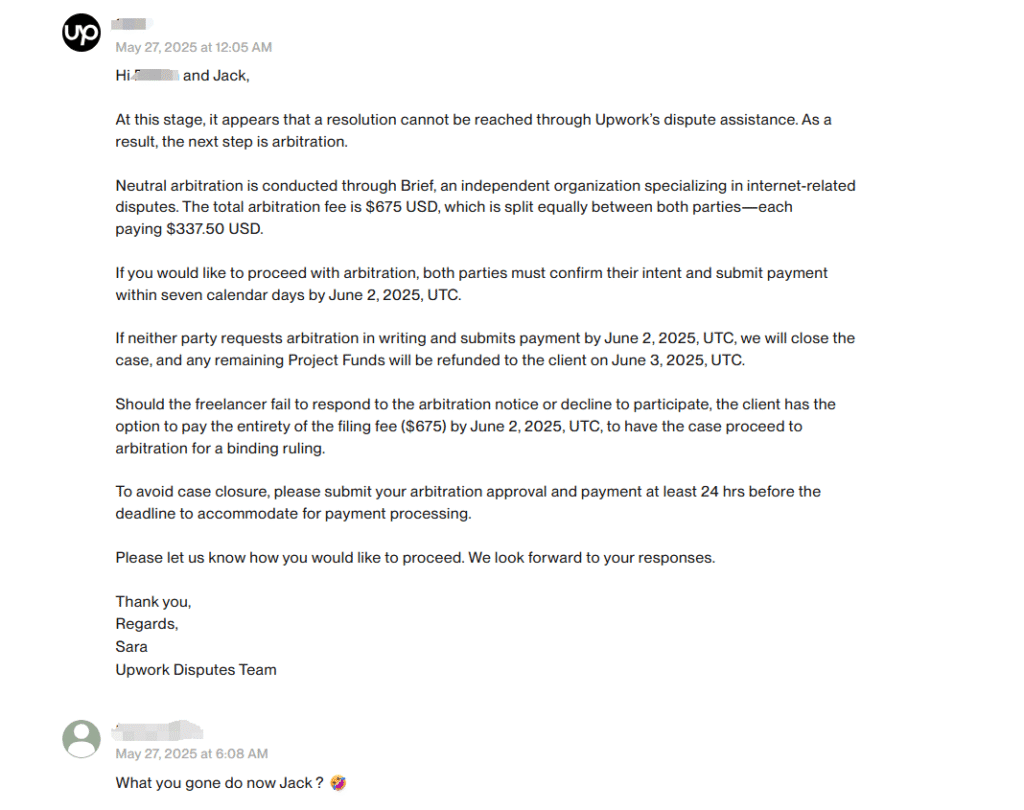

Return to Upwork

Based on the multiple disappearances of customer RB, intentional delays, refund requests, and the creation of an unreasonable refund process, we have lost trust in customer RB.

We requested the customer RB to return to the Upwork platform and provide us with the contract.

We strongly demand this, and got the contract in Upwork. But he refused during the Upwork payment process.

He applied for the revocation of the Upwork contract and requested a no-reason refund from PayPal.

Upwork Dispute Case

From May 22nd to 27th, we cost a lot of time to manage the evidence and made documents, and submitted files to the Upwork platform. But Upwork still unreasonably closed the contract. Everything was in vain and a lot of time was wasted.

Even, we lost 100% of our success badges and our account was penalized for violating Upwork terms(Although it is not our request to leave the Upwork platform, we also had advised the customer RB not to leave the Upwork platform).

Obviously, Upwork is more inclined to protect recruiters, and we have lost confidence in Upwork.

After all, we provided high-quality service, but fell into a scam and spent a lot of time appealing, resulting in nothing. Fortunately, we promptly identified the issue and did not send out the products, but these products were of no use to us and could only rot in the warehouse.

All we can do is focus on the future works.