Small home appliance products have small sizes, installation installation-free, and have relatively low unit prices, which are very suitable for e-commerce channels. Coupled with the promotion of the “home economy” during the COVID-19 epidemic, there has been a global wave of small home appliance purchases, and sales in markets such as Europe and America have exploded. As a world factory, China has attracted a large number of OEM and ODM orders from foreign brands.

As a professional China sourcing agent, SourcingBiz has also conducted market analysis.

In the second half of 2023, demand in the overseas home appliance market rebounded, and destocking in developed economies such as the United States came to an end. Coupled with the decline in inflation, the trend of Chinese home appliance exports was once again evident, and leading small home appliance sellers such as Roborock got sales volume and profits increasing.

The cake of small home appliances is getting bigger and bigger as it is made. Statista predicts that the global small home appliance market’s revenue had reached $254.3 billion in 2023, with an annual growth rate of 4.65% from 2024 to 2028. The sales of small home appliances in 2028 will reach 4.033 billion units. Kitchen appliances occupy half of the industry, for example, coffee machines alone reached a market share of $27 billion in 2023.

North America and Europe are the main export markets for small household appliances in China. On e-commerce platforms such as Amazon and eBay, small appliances are a hot selling category, including cleaning appliances, kitchen appliances, cooling appliances, and heating appliances. Various types of small appliances are gradually spreading throughout the corners of overseas consumer life. Chinese small home appliance companies are accelerating their overseas expansion, and in February, a famous Chinese electrical appliance manufacturer, Little Bear Electric Appliance Co., Ltd. specifically established two cross-border e-commerce companies to handle business and seek growth.

In China, there are four bases of the major home appliance industry, they are Shunde City, Cixi City, Qingdao City, and Hefei City. Small home appliance enterprises in these cities have roaring machines in their workshops, and the products they produce are being sold to Europe, America, Southeast Asia, Africa, and other regions through e-commerce platforms and other channels.

Chinese Small Household Appliances are Selling Well on e-commerce Platforms

Small household appliances have become an important export category in China’s cross-border e-commerce. According to statistics, the export value of small household appliances from China in 2022 was 115 billion yuan(CNY), a year-on-year increase of 28.7%.

Under the sustained influence of the international market, China’s home appliance exports increased by 14.7% year-on-year in December 2023. According to data disclosed by the General Administration of Customs of China, the export value of bread makers, electric ovens, mixers, vacuum cleaners, toasters, rice cookers, microwaves, and electric coffee machines increased by 51%, 29%, 16%, 14%, 13%, 12%, 11%, and 11% year-on-year in December, respectively.

Unlike essential household appliances such as air conditioners, refrigerators, and washing machines, small appliances belong to improved consumption. Therefore, with the upgrading of people’s quality of life and busy work schedules, the demand for small appliances is steadily increasing, and their penetration rate in the European and American markets is higher.

Small appliances include several categories: kitchen appliances (air fryers, coffee machines, fryers, toasters, juicers, etc.), cleaning appliances (vacuum cleaners, floor sweepers, air purifiers, mite removers, etc.), personal care appliances (hair dryers, electric toothbrushes, straight hair combs, curling sticks, hair removal devices, etc.).

According to data from several major e-commerce platforms such as Amazon, eBay, TikTok, and Temu, small appliances have always been a high demand category.

Chinese Small Appliances on Amazon

On Amazon, air fryers, coffee machines, vacuum cleaners, and electric toothbrushes are all consistently popular products. How was their sales last year?

According to MarketIDX’s data, the sales of vacuum cleaners, air purifiers, humidifiers, vacuum cleaners, coffee machines, and air fryers on Amazon’s US site are still impressive in 2023.

Among them, the sales of vacuum cleaners reached as high as $2.19 billion, a year-on-year surge of 47.2%, with sales reaching 2.078 million, a year-on-year increase of 33%, and the average price of goods was $109.12; The sales revenue of coffee machines reached $860 million, with a sales volume of 11.717 million and an average product price of $73.06; The sales revenue of household air purifiers was $827 million, a year-on-year increase of 4.7%, with sales of nearly 8 million, a year-on-year increase of 11%, and an average product price of $103.8; The sales revenue of the vacuum cleaner reached $780 million, a year-on-year decrease of 15.1%, and the sales volume was 3.017 million, a year-on-year decrease of 9.9%. The average price of the product was relatively high, at $258.89.

The sales of air fryers also continued to rise, reaching $510 million in sales, a year-on-year increase of 11.9%, with sales exceeding 5 million pieces and an average product price of $101.9. From the sales ranking, the annual sales of the top 8 products are generally above 100000 units, with the highest exceeding 200000 units. Most of the other products in the top 20 have sales between 20000 and 50000 units, with product prices ranging from $82 to $240.

Among these top-selling small home appliance products, small home appliances produced from China occupy multiple seats.

Chinese Small Appliances on eBay

Due to seasonal changes, the start of the school season, Father’s Day, and other factors, home appliances became a hot search category on eBay’s US site in May last year. Consumers frequently search for products such as portable fans, portable air conditioners, mini refrigerators, ice makers, etc.

Summer is just one of the battlefields for small appliances. eBay analysis shows that in the United States, there is a high proportion of large apartment environments, which puts a lot of pressure on whole house cleaning. Most families also lay carpets and keep pets, and the cleaning work is heavy. The demand for cleaning tools is high, and vacuum cleaners and robotic vacuum cleaners have always been popular categories for home appliances on the US website. The spare parts market is also continuously growing.

Americans have the habit of cooking at home, and in addition to the hot air fryer, the toaster driver, blender, coffee machine, and other kitchen appliances are also the most concerned by local consumers. The traffic on eBay America has steadily increased.

Chinese Small Appliances on TikTok

The TikTok full hosting mode is very suitable for merchants with spot inventory and factory types to settle in. China’s small home appliance products have always maintained a high popularity, and the video playback under the tag #chinagadgets quickly exceeded 100 million. Sweeping robots, temperature display insulated cups, intelligent voice recognition speakers, and underwear-specific washing machines have all fascinated netizens, and “China Smart Manufacturing” small home appliances have completed a wave of cultivation.

According to a research report by Orient Securities, Chinese home appliance companies are gradually expanding into TikTok shops in the United States. In terms of categories, clean home appliance companies are more active, with Roborock, Dreame, and Tineco all opening TikTok Shops and selling on them. Currently, the TikTok platform is still a blue ocean of home appliances.

Chinese home appliance brands are on the rise. Based on the operation experience of the Douyin(Chinese domestic version of Tiktok), Chinese home appliance brands have started to use TikTok more quickly, while overseas brands have been slow to respond to new channels, and have not opened stores, giving huge market dividends to Chinese household appliance brands. This will also be an opportunity for Chinese small home appliance brands to overtake.

Chinese Small Appliances on Temu

Temu is racing overseas and has also opened categories for home appliances and smart homes, selling products such as hair dryers, juicers, and massage machines. However, the current product quantity still needs to be enriched.

However, most well-known small home appliance brands in China have not yet established the Temu platform. On the one hand, the company’s overseas business is not sensitive enough or is still observing, and on the other hand, the platform has set thresholds for high-priced products in the early stage. Therefore, Temu’s small home appliance products are mainly white brand products, and well-known brands can quickly open up the situation.

A leading home appliance seller opened a Temu store in the first half of 2023. Due to the limited number of sellers in their category and low price pressure, they quickly started selling under the “brand power+mature sellers+compliant products” model. At present, the sales of the store are steadily increasing, and the company is launching new stores.

Relying on e-commerce channels and offline supermarkets, Chinese small home appliances are rapidly seeking gold overseas.

During the 2023 Black Friday festival, Roborock’s GMV in North America increased by 30% year-on-year. Even with its own new factory, production pressure is still very high. Coupled with the production capacity of contract factories, supply still exceeds demand.

XGIMI is walking on two ways overseas, not only laying out mainstream channels such as Amazon and Rakuten in Japan, but also gradually entering major offline retail channels in Europe, the United States, and Japan. Its market share in the Japanese home projection market has been ranked first for many consecutive years.

Three Types of Chinese Small Home Appliance Participants Entering the International Market

Compared to playing the role of “follower” in many categories, the overseas performance of Chinese small home appliances is stunning and has begun to lead the market.

Taking clean household appliances as an example, the recent Daily Economic News and Shenzhen Yishi Technology jointly released the “Cross border E-commerce Intelligent Clean Household Appliance Brand Influence List (2023/12)”, with Chinese brands occupying the majority of the seats. The top ten brands are Dyson, Roborock, Eufy, Shark, Dreame, iRobot, Tineco, NARWAL, Ecovacs, and ILIFE, with 8 Chinese brands among them, all of which have independent websites and Amazon sales channels.

Dyson ranks top in the list, with vacuum cleaners as its main focus and ranking first in search popularity, far surpassing brands such as Robolock, Robobot, Ecovacs that specialize in vacuum cleaners and mopping robots. However, with the upgrading of innovation and technology, Chinese brands are eroding the market share of top overseas brands. Although the American brand iRobot is the pioneer of robotic vacuum cleaners, its market position has been continuously declining under the siege of later waves, and it has now fallen behind Roborock, Dreame, and others.

Small home appliances are not the main battlefield for traditional giants, as they invest relatively little, leaving market space. For example, some emerging small home appliance brands with segmented categories have the opportunity to enter the super channels of large chain stores such as Sam’s stores in North America. This is impossible in the big home appliance industry, as the channels are firmly occupied by giants.

Currently, going abroad has become an important way for Chinese home appliances to seek growth.

SourcingBiz divides Chinese home appliance merchants engaged in exports into three types of participants.

- The first type is established home appliance giants, represented by Midea, Haier, and Gree.

- The second type is represented by smart home appliance companies such as Ecovacs, Roborock, and Dreame, which promote a series of home cleaning products overseas.

- The third type is mainly China domestic small home appliance companies such as Joyoung, Little Bear, SKG, etc., which have now expanded their overseas business.

The Four Major Industrial Bases of Small Home Appliances in China

In the small home appliance industry, multiple Chinese brands have already reached the top sellers, how is this achieved?

Andreas’ analysis shows that China’s home appliance software and hardware supply chain has obvious advantages, with abundant talent and fast product iteration. It can make differentiated functional innovations, and consumers can intuitively feel the differences through the products, forming positive feedback and accelerating the overseas penetration of small home appliances in China.

According to Ye Yindan, a researcher at the Bank of China Research Institute, Chinese home appliance companies have shifted from entering the overseas mid to low-end market with high-cost performance products in the past to relying on research and development to enter the overseas mid-to high-end market, and continuously innovating to enhance their comprehensive competitiveness. It is expected that this situation will continue.

The takeoff of small home appliances in China relies on the support of abundant domestic industrial bases.

China has four major bases for the home appliance industry: Cixi City in Zhejiang, Shunde City in Guangdong, Qingdao City in Shandong, and Hefei City in Anhui. Cixi City is a famous hometown of small home appliances.

According to ShineGlobal, Cixi City produces and manufactures about 60% of the world’s small home appliances, such as nearly 30 million electric irons per year, accounting for about 50% of the global market share. Home appliance brands such as Fotile, Bull, and CUORI all come from this “smart small appliance manufacturing town”.

Official statistics show that smart home appliances are the largest pillar advantage industry in Cixi City. In 2021, the output value of the city’s large-scale smart home appliance industry exceeded 100 billion yuan, reaching 104.26 billion yuan(CNY). There are over 2000 complete machine manufacturing enterprises and nearly 10000 supporting enterprises in Cixi City, with products covering more than 20 series and up to thousands of categories.

The Chinese home appliance industry has met a considerable amount of global demand for small home appliances. Due to the increase in disposable income and lifestyle changes, people’s demand for small home appliances is expected to increase, and the continuously growing market will feed back Chinese home appliance industry.

The Future Trends of Chinese Small Home Appliances

Statista predicts that the global small home appliance market’s revenue will reach $254.3 billion in 2024, with an average household sales volume of 1.7 units. From 2024 to 2028, the annual growth rate of this market is 4.65%, and the sales of small home appliances in 2028 will reach 4.033 billion units.

In 2023, North America dominated the global small home appliance market with a share of $39 billion, due to the expansion of regional electrification and urbanization, as more and more people migrated to cities. The demand for kitchen appliances is increasing, and the growth of disposable income further fuels this trend.

Among them, kitchen appliances can be widely used in households, restaurants, schools, and other commercial places, occupying the largest market share. In 2022, kitchen appliances accounted for 52.90% of the market share in the entire small home appliance market, and are expected to continue to grow in the coming years.

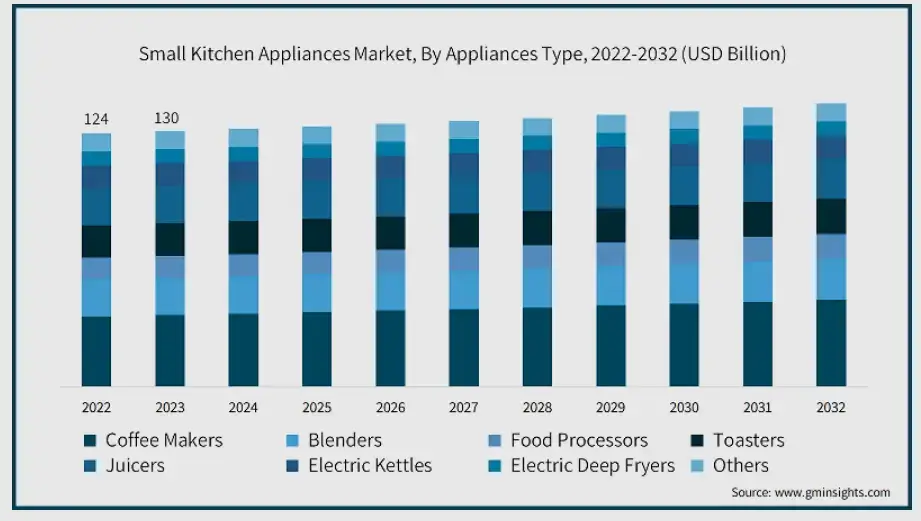

According to Global Market Insights analysis, the value of kitchen appliances in 2023 is $130 billion, and it is expected that the total annual growth rate from 2024 to 2032 will exceed 4.7%, with a value of $205 billion by 2032.

Europe and North America are the leaders in the kitchen appliance market, with a compound annual growth rate of 5.9% from 2022 to 2028. With the increasing awareness and living standards of countries such as China, India, and Japan, the Asia-Pacific market is expected to experience significant growth.

Kitchen appliances mainly include coffee machines, mixers, food processing machines, toasters, juicers, electric kettles, electric fryers, etc. The following are the growth expectations for various products in the next 8 years.

In 2023, coffee machines held a market share of $27 billion, providing a fast and convenient way to brew coffee at home. Users can simply press a button and enjoy a fresh cup of coffee in just a few minutes, especially on busy mornings, saving a lot of time and effort.

With these small appliances, consumers can more effectively cook, wash, or perform personal beauty, greatly saving the time required for activities.

On the one hand, new markets are constantly emerging, and on the other hand, China home appliance companies are constantly investing in research and development to create more attractive new products, which also promotes the growth of market size. Next, which markets have greater growth potential?

- Asia Pacific region. The local population continues to grow, and coupled with the increasing number of commercial and residential buildings in countries such as India, China, Japan, South Korea, and Bangladesh, the demand for small household appliances is expanding.

- South America. Due to rapid industrialization and urbanization in countries such as Brazil and Argentina, the South American small home appliance market is expected to grow at a compound annual growth rate of 4.61% during the forecast period.

- North America. The penetration rate of household appliances in North America is relatively high, and it has become a mature small home appliance market. In addition, home appliance companies continue to market and launch new products in this market, expand their business, and increase the revenue of the entire market.

In addition, the shift in consumer demand for sustainable home appliances that save energy and reduce environmental hazards is expected to drive market growth.

The Challenges of Chinese Small Home Appliances

After making rapid progress, the Chinese small home appliance industry has also begun to face challenges.

Due to the increasing penetration rate of small household appliances and fierce market competition, manufacturers can only face the pressure of constantly developing new products and launching more product versions, which can attract consumers who value diversified choices.

Due to fierce competition, consumer demand for reasonably priced kitchen appliances has increased, leading home appliance companies to launch various products at prices comparable to their competitors and shift their focus from high-income groups to middle-income and low-income groups.

In addition, small appliances are lightweight and easy to use, but they are also more prone to wear and tear compared to large appliances, have a shorter lifespan, and consumers may need to replace them frequently. For example, small household appliances such as microwaves, irons, dishwashers, and coffee machines have a short lifespan and therefore require frequent maintenance or replacement, which may inhibit the market growth of small household equipment.

From the perspective of overall environmental factors, there are fluctuations in overseas demand, raw materials, and shipping costs, and industry competition continues to intensify. Some companies will inevitably fall behind, resulting in lower-than-expected demand growth.

There is still a long way to go for China small appliances in the international markets.